The time has come. The final days of 2018 are drawing to a close, and that means it’s time for Forter’s year-end wrap up. 2018 has been an exciting year, with much growth and development in the online payment industry. Here are some of the most memorable highlights:

The Devil is in the Details

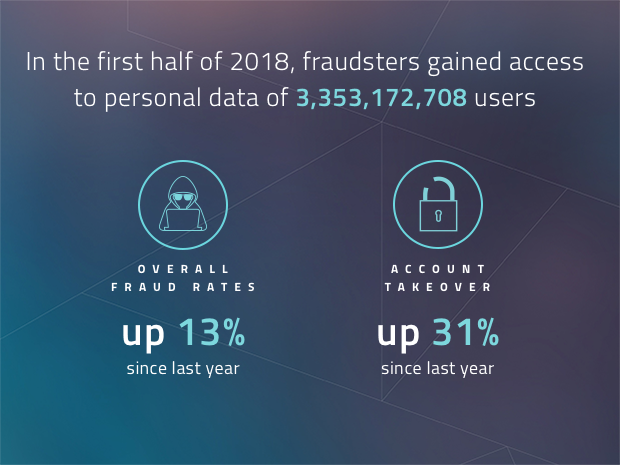

In this case, the online devils (fraudsters) are in 3,353,172,708 people’s personal details (just within the first half of 2018 alone!). 2018 saw a significant increase in data breaches, with companies like Marriott, Facebook, Google+ and Under Armour, among the targets. The scale of these attacks indicates that online fraudsters’ appetites for data have grown, and their abilities to successfully exploit more notable (and assumably more well-protected) companies have increased as well.

The wealth of available data online, both as a result of these large-scale breaches and the nature of the rising rate of online activities as a whole, means that fraudsters have more avenues than ever before by which to exploit online entities.

Rising Trends in Fraud

Fraudsters have certainly capitalized on this data, ripe for the picking. Fraud rates overall increased by 13% since last year, and show no signs of abating in the new year. Fraudsters have also discovered that there is far more value, and easier ways to commit online fraud. The discovery of vulnerable touch points along a customer’s shopping journey before the point of transaction or checkout, have made account data far more valuable to fraudsters than ever before.

Account Takeovers (ATO) and Loyalty Points and Return Abuse, Oh, My!

Exploiting customer accounts has become a growing phenomenon across online industries. Account takeovers (ATO) have grown by 31% year over year and data indicates that these types of attacks will only continue into the year ahead. ATO is a fraud method whereby fraudsters hack into a user’s account and use the payment method attached to the account to make purchases. This type of attack is particularly difficult to address, as the good reputation of the account will likely persuade most sites to either allow purchases to be made, or to be very careful before denying it, since no one wants to reject an order from a valued customer.

Once a fraudster has access to a user’s account, there are other points of vulnerability as well. Forter has seen a rise in loyalty point program abuse as well as return abuse. Fraud at the point of transaction is no longer the only focus for online criminals. Fraudsters are examining the customer journey completely, and assessing points along the journey to checkout, that could simultaneously have value and vulnerabilities. Customers who favor certain brands will often accrue loyalty points with their favorite merchants. These points are essentially free money for fraudsters once they gain access to a customer’s account. They are also more vulnerable because users are far less likely to check on the status of their points than they would be to check their bank account statements for foul play. As such, fraudsters can enter the account undetected, drain the loyalty points, and the user would be none the wiser.

Return abuse spiked in the last year, increasing by 119%. This type of abuse has grown so problematic across industries that even large brands like Nordstrom, Costco, and L.L.Bean have modified their once more liberal return policies. Many brands will now flag accounts they see as returning too many products, both in-store and online.

Friction in the Journey

These new methods of fraud attacks and abuse are problematic for both the customer as well as the merchant. For end users, an experience of a hacked account can disturb their loyalty to brands and diminish their lifetime value. Once victim of an ATO, a customer is likely to have increased mistrust of a specific brand and feel less inclined to share their personal preferences and details on that particular site in the future.

For the merchants, the user experience is incredibly valuable. The aforementioned fallout that can occur after an ATO attempt or when loyalty points are stolen from their account can mean loss of once loyal consumers and huge gaps to a merchant’s once reliable customer base. In order to prevent these types of occurrences, merchants are likely to attempt to ramp up their fraud prevention. But equipped in most cases with legacy systems based on rules, these changes will only increase customer friction on their site (delays in manual review queues, more cautious rules thereby increasing insult rates to potentially good customers, etc.), and have a far more negative impact on the business than anticipated.

The payments industry has been busy this year, but so have we!

In Forter News…

2018 was a year of growth and development. Transactional fraud prevention has become the status quo for providers in the online payments space and the new frontier of fraud prevention will need to protect the customer journey from end to end.

Since last year, Forter’s network has increased to 1.4B active devices and has grown to nearly 150 million people known to our system. Our network also saw major growth in the countries in which we see activity.

We were named to the 2018 Forbes’ Fintech 50, Fast Company’s 2018 Most Innovative Companies list, and CB Insights’ Fintech 250 list. Forter also earned a Stevie Award for excellence in sales and customer service and a Best in Biz award for ‘Most Innovative Company of the Year.’ In addition, the Electronic Transaction Association celebrated CEO, Michael Reitblat, for his contributions to revolutionizing the digital payments ecosystem on its Forty Under 40 list.

Investors also continued to recognize Forter’s promising business. In September, Forter secured $50M in Series D financing from investors like March Capital and Salesforce Ventures, marking our largest funding round to date, joining our existing network of investors. This achievement is the latest in a series of corporate milestones for us, enabling us to keep expanding even faster. This activity builds on the momentum of our processed transactions volume growing 1200%, and the significant expansion of our international presence.

We move into 2019 with exciting energy aimed at growing our incredible employees, refining and expanding our product offerings, and ensuring that our clients always receive the very best.

2019 fraudsters, beware. Forter is here and stronger than ever, covering your chargebacks and preventing fraud at the point of transaction and every touchpoint in between.